Parwaz Card Loan Scheme 2026

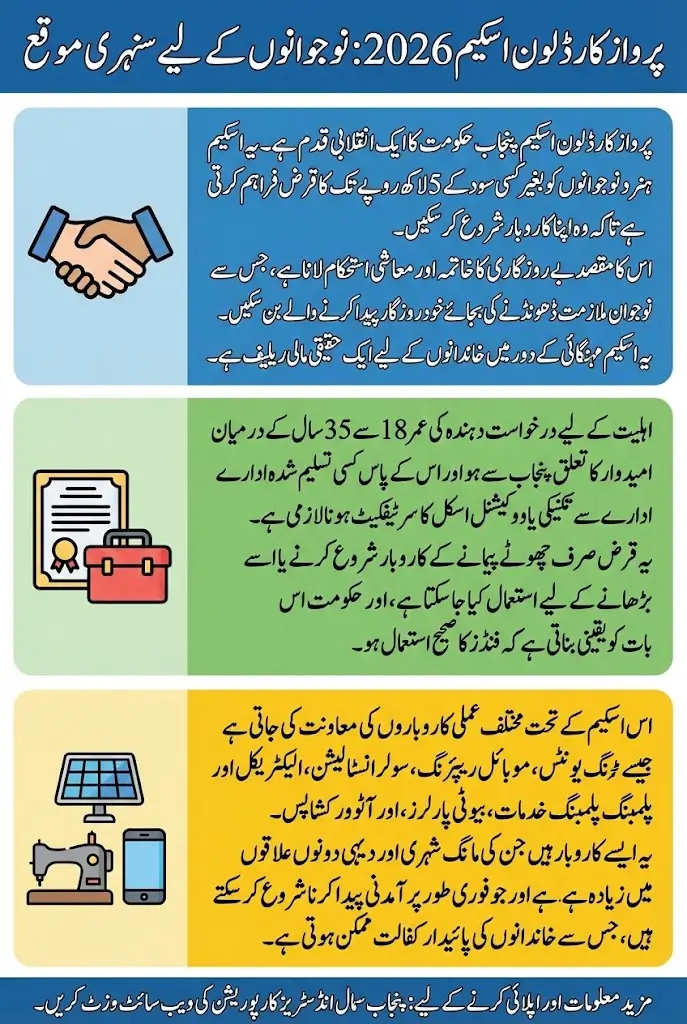

Parwaz Card Loan Scheme 2026 is one of the most important youth empowerment initiatives launched by the Government of Punjab this year. At a time when inflation, unemployment, and rising business costs are affecting families across the province, this interest-free loan program offers real financial relief to skilled young individuals who want to start or expand their own businesses. The scheme provides up to Rs. 500,000 without any interest, which makes it a golden opportunity for those who have skills but lack capital.

This initiative is being implemented through the Punjab Small Industries Corporation to promote self-employment and strengthen small industries in Punjab. The government’s focus is clear: instead of depending only on government jobs, youth should be encouraged to become job creators. From tailoring units to mobile repair shops and solar installation services, the scheme supports practical, income-generating businesses that can sustain families for years.

You Can Also Read: Maryam Nawaz Ramazan Bazaars 2026

Why Parwaz Card Loan Scheme 2026 Is Important for Punjab Youth

In my observation, many young people complete technical courses but remain unemployed because they cannot afford tools, rent, or initial stock. Banks usually demand heavy collateral and charge high markup. This scheme removes that burden completely by offering 0% interest financing.

The importance of this scheme can be understood in the current economic situation. Small businesses are the backbone of Punjab’s local economy. When skilled youth receive financial support, they not only improve their own lives but also create employment for others in their communities. This ripple effect can reduce poverty and promote economic stability across districts.

Key reasons why this scheme matters in 2026:

- It provides completely interest-free loans

- It targets technically trained and skilled youth

- It encourages entrepreneurship instead of job dependency

- It reduces financial pressure during business startup

- It strengthens small-scale industries in Punjab

This is not just a loan; it is a structured opportunity to build a sustainable livelihood.

You Can Also Read: CM Punjab Honhar Laptop Scholarship 2026

Businesses Supported Under the Parwaz Card Initiative

The Parwaz Card Loan Scheme 2026 focuses on skill-based micro and small businesses. These are businesses that require moderate investment but can generate steady monthly income when managed properly. The government is particularly supporting trades that have high demand in both urban and rural areas.

Many of these businesses are practical and service-based, which means they start earning quickly after setup. Skilled individuals who already have training can immediately use the loan to purchase equipment, tools, furniture, or raw materials.

Common business categories include:

- Tailoring shops and boutique setups

- Mobile phone repairing and accessories business

- Solar panel installation and maintenance services

- Electrical wiring and plumbing services

- Beauty salons and home-based parlors

- Auto workshops and mechanical services

Applicants must ensure that the loan is used strictly for business purposes. Misuse of funds can lead to penalties or disqualification from future government schemes.

You Can Also Read: Winning Numbers for 100 Prize Bond Karachi

Complete Online Application Process Step By Step

The application process for the Parwaz Card Loan Scheme 2026 has been designed to be simple and transparent. The government has shifted the system online to reduce corruption and ensure equal opportunity for all eligible applicants.

First, applicants must visit the official portal of the Punjab Small Industries Corporation or the PSER platform. After accessing the portal, they need to create an account using their CNIC number and a mobile number registered in their own name. An OTP verification process is usually required to confirm identity.

After registration, the applicant must carefully fill out the online form. This includes personal details, household income information, skill certification details, and a short business plan explaining how the loan will be used. Accuracy is very important because incorrect information can delay or reject the application.

You Can Also Read: 1500 Prize Bond Draw Result February 2026

Main steps in the application process:

- Visit official PSIC or PSER portal

- Register using CNIC and mobile number

- Complete OTP verification

- Enter personal and income details

- Provide skill certification information

- Upload required documents

- Submit application and receive tracking ID

Once submitted, the applicant receives a reference number that can be used to track the application status online.

Required Documents for Loan Approval

Proper documentation plays a crucial role in the approval process. Many applications get delayed because documents are incomplete or unclear. Applicants should prepare all required documents before starting the online form.

You will need the following:

- Valid Computerized National Identity Card (CNIC)

- Punjab domicile certificate

- Technical or vocational certificate from a recognized institute

- Basic business plan or proposal

Skill certificates should be issued by recognized institutions such as Technical Education and Vocational Training Authority or Punjab Vocational Training Council. These certificates confirm that the applicant has proper training in their chosen field.

All scanned copies must be clear and readable to avoid verification issues.

You Can Also Read: 9999 PM Nigehban Ramzan Relief Package 2026

Eligibility Criteria for Parwaz Card Loan 2026

The government has set clear eligibility requirements to ensure that deserving and skilled youth benefit from the scheme. These conditions are designed to maintain fairness and transparency.

To qualify for the Parwaz Card Loan Scheme 2026:

- Age must be between 18 and 35 years

- Applicant must be a permanent resident of Punjab

- Must possess a valid technical or vocational skill certificate

- Loan must be used only for starting or expanding a small business

- Applicant’s socio-economic data should be updated in official records

Authorities may verify data through government databases, so applicants must ensure that their information is accurate and up to date.

You Can Also Read: PM Youth Business Loan 2026 Interest-Free Program

Loan Amount, Features and Repayment Structure

The most attractive feature of this scheme is its completely interest-free structure. Unlike bank loans where markup increases the total repayment amount, here you only repay the exact amount you borrow. This makes financial planning easier for new entrepreneurs.

The approved loan amount depends on the strength of your business proposal and financial evaluation. Applicants with clear, realistic business plans have higher chances of receiving larger amounts.

Below is a summary of key financial details:

| Feature | Details |

|---|---|

| Scheme Name | CM Punjab Parwaz Card Loan Scheme 2026 |

| Loan Amount | Rs. 50,000 to Rs. 500,000 |

| Interest Rate | 0% (Completely Interest-Free) |

| Repayment Period | 2 to 3 Years |

| Installments | Flexible Monthly Installments |

| Managing Authority | Punjab Small Industries Corporation |

| Target Group | Skilled Youth (18–35 Years) |

The repayment period usually ranges from two to three years, with affordable monthly installments designed to avoid financial stress.

Offline Support and Assistance for Applicants

For those who are not comfortable with online systems or face technical issues, the government has also provided offline assistance. Applicants can visit their nearest e-Khidmat Markaz or the district office of the Punjab Small Industries Corporation.

At these centers, officials guide applicants in filling out forms, uploading documents, and verifying information. This support is especially useful for applicants from rural areas who may not have stable internet access.

Offline support ensures that no deserving applicant is left behind due to technical difficulties.

Final Thoughts

The Parwaz Card Loan Scheme 2026 is a practical and impactful initiative aimed at empowering skilled youth across Punjab. By offering up to Rs. 500,000 at 0% interest, the government is removing one of the biggest barriers to entrepreneurship: lack of capital.

For young individuals who have completed technical training and are serious about starting a small business, this scheme provides a real opportunity. With proper planning, responsible use of funds, and timely repayment, this loan can become the foundation of a stable and successful future.